阅读更多关于当前绿皮书提案的信息. ...

本网站使用cookie,以确保我们给您最好的用户体验. cookie协助导航,分析流量和我们的营销工作,如我们的 隐私政策.

9月20日th, the SEC finalized its amendment to the Investment Company Act of 1940 (“Act 40”) that addresses the naming convention of certain investment companies.

这些变化包括对使用环境、社会和治理术语的基金的各种影响, 包括, 但不限于, “绿色”, “可持续”和“影响”.“基金必须在联邦公报最终公布裁决后的24个月内遵守规定. 可能的执行日期是2025年的某个时候.

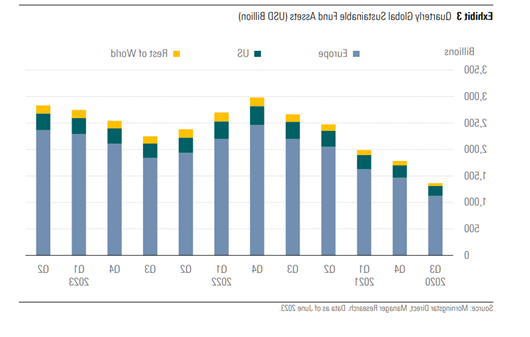

The growth of investing in 环境、社会和治理 and Sustainable funds across both Europe and the US has been substantial over the past three years. 尽管在2021年第四季度达到了3美元的峰值.0万亿年, cumulative assets under management (“AUM”) in 环境、社会和治理 funds have been steadily rising again over the last year and reached their second-highest total by the end of Q2 2023:

图片来源: http://www.morningstar.com/lp/global-esg-flows

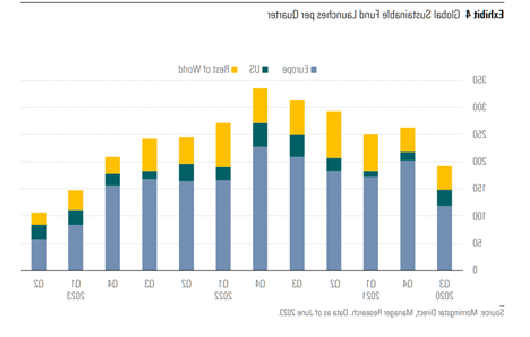

此外, the number of funds launched in the US with 环境、社会和治理 and Sustainable names has stayed relatively steady over the past several years, 尽管在欧洲和全球其他地区有所减少:

图片来源: http://www.morningstar.com/lp/global-esg-flows

在欧洲, tenets of the Sustainable Finance Disclosure Regulation (“SFDR”) govern the way that funds promoting environmental or social characteristics (“Article 8”) or those with a sustainable investment objective (“Article 9”) must disclose their intent both qualitatively and quantitatively to align with their stated objectives. 此外, periodic reporting back to the client is mandated in order to monitor progress against those espoused objectives.

All of this is to say that there has not been a corresponding regulatory initiative in the US to address a number of the concerns that exist in the marketplace. 这些问题包括基金资产与基金策略的一致性, the way in which a fund defines how it invests from an 环境、社会和治理 perspective and treatment of items such as portfolio drift and derivatives. 美国证券交易委员会名称规则的扩展提供了这种清晰度,并侧重于以下关键要素:

Funds with names indicating that they emphasize or incorporate 环境、社会和治理 factors must now align 80% of their investments to those factors. It’s important to note that the final ruling does not crystallize how funds should define certain terms; for example, two funds’ names with ‘Climate Change’ in the by行 may have radically different definitions of that terminology and how their investments will align accordingly.

最终裁决为偏离80%的规定提供了更大的灵活性. "在正常情况下,"资金应该与80%保持一致.’ This is a slight softening of language from the original proposal indicating departure is only allowed under specified circumstances. 此外,基金必须有一个程序,至少每季度审查与80%的一致性.

最后, the finalized rule allows funds 90 days to realign to their mandated 80% if the portfolio is out of alignment due to natural portfolio drift or another departure falling under the “normal circumstances” clause.

最终裁决强调名义金额, standardized to the 10-year bond equivalent of derivative holdings must be used to calculate 80% alignment as opposed to the market value of the holding. 另外, any derivatives used as currency hedges must be removed from the calculation of the 80% and can deduct cash or US treasuries with maturities under 1 year from the final calculation.

Funds will need to begin adding definitions in their prospectus relating to 环境、社会和治理 factors that they emphasize. 如前所述,最终裁决为基金定义这些术语提供了灵活性.

按季度计算, funds will now need to specify whether each investment holding aligns with one of the emphasized 环境、社会和治理 factors and quantify what % of their total portfolio is aligned, 按照他们的定义.

This could be a heavy lift for funds’ Risk 管理 and Compliance departments and should be considered one of the most extensive parts of the final ruling!

A fund must maintain written records at the time of investment that state whether the investment is included in the 80% bucket, what the basis for the inclusion of that investment is and the % value of the aligned assets relative to total assets. 此外,基金必须保持其内部职能的记录,如1st 和2nd 行, have reviewed portfolio holdings and justification for inclusion in the 80% bucket on at least a quarterly basis. 最后, any departure from the 80% alignment due to portfolio drift or as a result of the “under normal circumstances” clause must be rationalized, 评审并形成相应的文件.

A notable omission from the final legislation is an explicit direction from the SEC on 环境、社会和治理 funds emphasizing “环境、社会和治理 Integration.” 环境、社会和治理 integration is a complicated and opaque part of the 环境、社会和治理 investing world and has generated scrutiny and regulatory action from the SEC previously related to greenwashing claims of fund managers.

尽管在这方面缺乏监管方向,但SEC发出的信息很明确:

如果你公开披露你的基金是如何投资环境、社会和治理领域的, 您需要清楚地定义和实现方法, 治理, 和控制来保卫它.

如果您对本文或其他与esg相关的主题有任何疑问, 请与我们的环境、社会和治理团队联系 (电子邮件保护).

相关链接

凭借我们的行业专业知识和对风险咨询领域的广泛了解, the Schneider Downs team can help your organization perform a gap assessment relative to the finalized regulation, 提出改善的地方, 并符合美国证券交易委员会名称披露要求.

了解更多关于我们的环境、社会和治理咨询bet9平台游戏 3flpia.readingweb.net/esg 或bet9平台游戏的团队 (电子邮件保护).